In May 2022, shortly after my story about Chinese loan sharks in West Africa went up, a number of new tips and leads started trickling in. It looked at first, as though a follow-up story would emerge, focusing on how some Nigerian banks still offer banking services to illegal loan sharks despite CBN regulations expressly forbidding this. Wema Bank – unsurprisingly – was the most regular offender in this category, lending its support to multiple illegal loan sharks up until as recently as the time stamps in the images below. As I trawled through the leads and my own mounting pile of untold story ideas sitting on my Google Drive however, I started to realize something – there was a much greater issue at play here than a few banks bending KYC rules to bank some customers that ought not to be banked. These were borderline unbelievable stories – stories about aggressively fraudulent behavior by Nigerian banks presented with evidence that was as devastating as it was undeniable. What is more, these were not stories about a few “bad eggs” in the Nigerian banking sector. Pretty much all of Nigeria’s major banks were implicated, albeit to differing extents. In the interest of brevity, an editorial decision was made to tell the 4 most disturbing stories in no particular order. There is a story about collusion with regulators to cheat customers and brazenly steal their property. There is a story about illegal, unauthorized account openings which potentially expose customers to an entire world of pain and liability. There is even a story about brazen collaboration with ponzi schemes and illegal investment programs. Most alarmingly, there is a common denominator of regulatory weakness and complicity, if not outright collusion across all the stories, which culminates in a story about inflows from Qatar potentially financing terrorism in Nigeria for well over a decade. While working on this story, I reached out to no fewer than 6 financial institutions and regulators who were implicated in the maze of documents and testimony I went through. As always, they had nothing to say. WEMA, UBA And The Unwanted Accounts: Nigeria’s Wells Fargo Moment?In 2016, a scandal broke out at Wells Fargo Bank, which at the time was the world’s largest bank. It emerged that over 3.5 million accounts had been secretly opened for customers without their knowledge and authorization, in response to unrealistic in-house sales and marketing targets. Staff were incentivized to open as many accounts for their customers as possible, and the bank knowingly looked the other way when basic KYC protocols such as customer permission were breached.

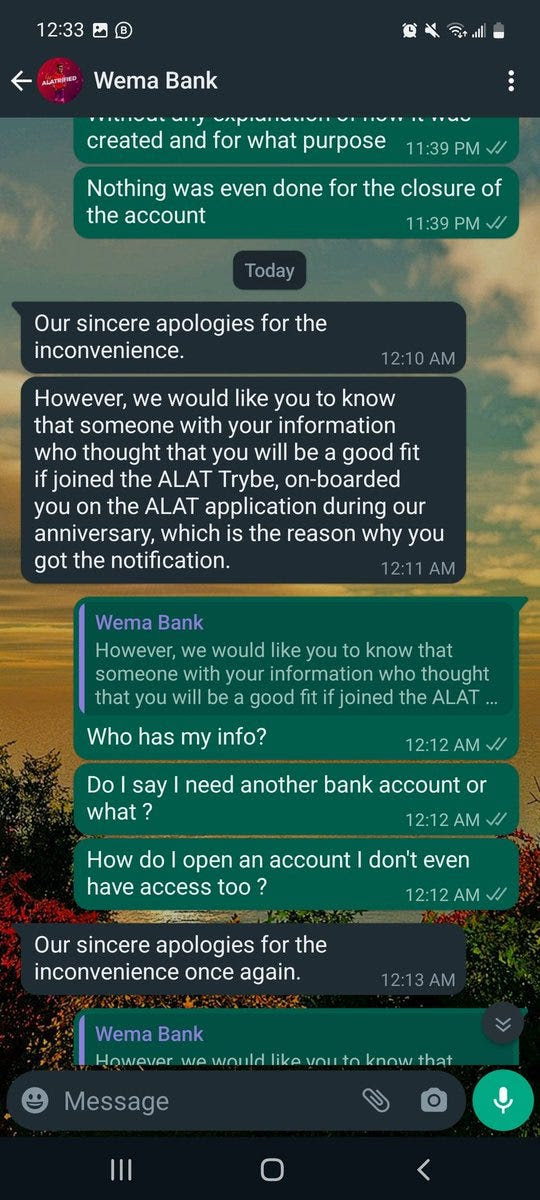

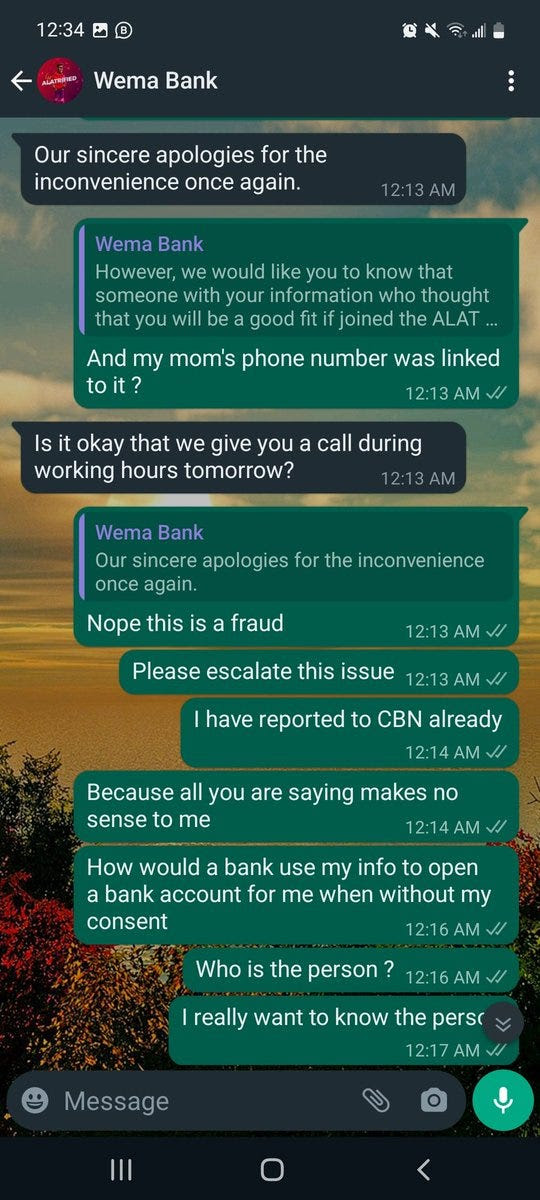

In response to the scandal, Wells Fargo fired over 5,000 employees and paid over $3 billion in penalties under a settlement announced by the US Justice Department in 2020. Given the amount of damaging publicity the scandal received, it became an opportunity for banks and banking regulators around the world to review and tighten their operating practices to avoid getting caught up in a similar mess. In Nigeria however, it was treated not as a cautionary tale, but as inspiration for a potentially even bigger brewing scandal. From May 2022 for example, hundreds of tweets like this began appearing:  🦋🦋🦋Arya Stark 🦋🦋🦋💕 @cute_pecky 🦋🦋🦋Arya Stark 🦋🦋🦋💕 @cute_pecky June 2nd 2022 7 Retweets4 Likes  Olatayo🇳🇬 @adebayopeterO2 Olatayo🇳🇬 @adebayopeterO2 May 23rd 2022 539 Retweets373 Likes Apparently, to celebrate the 5th anniversary of Wema Bank’s digital banking division ALAT, the bank had set a target for its sales team that could either be described as quite ambitious or entirely insane, depending on which side of the fence you stand on. The target, the bank said, was to open 1 million new accounts in one day. For reference, Nigeria had about 134 million bank accounts in 2021, which meant that Wema wished to increase this number by almost 1 percent in just 24 hours. Even more incredibly, when the bank would later go on to announce that it actually somehow achieved this target, it somehow did not raise an eyebrow. Apart from some excellent work by Olalekan Fakoyejo of Ripples Nigeria, the potential severity of the financial crime that had just been perpetrated on thousands – possibly hundreds of thousands – of Nigerians went completely unreported. In some instances, the bank openly admitted to some of these new “customers” who raised a challenge, that they had been illegally onboarded without their knowledge and consent “because someone with their information thought they will be a good fit.”  Olatayo🇳🇬 @adebayopeterO2 Olatayo🇳🇬 @adebayopeterO2Behold this was the response i got from @wemabank and I do not understand what the bank means   May 23rd 2022 184 Retweets208 Likes When this particular gentleman reached out to the bank via email to pursue the issue further, he got the following response. Putting aide the disingenuousness of claiming that a customer has nothing to be worried out because an account fraudulently opened using his identity is allegedly not linked to his Bank Verification Number (BVN), this email also failed to deal with an equally pressing issue which he reiterated below. In other words, there is a clandestine market for private information of Nigerians that Wema Bank apparently has access to. What is more, it is not just Wema Bank. Other banks have also been accused of unauthorized account openings, but perhaps it is the example of UBA that illustrates the sheer depth of criminality and fraudulent behavior that increasingly characterizes the relationship between Nigerian banks and their customers. This particular story is taken from a case file at the Federal High Court in Lagos, where on May 6, 2022, Justice Akintayo Aluko became the first Nigerian judge to issue a ruling against a Nigerian bank for opening an account using a customer’s identity without their knowledge and authorization. The full case file is available here. According to the case file, the complainant, Mr. Chiebuka Nworah received a $450 payment in March 2021. Instead of his UBA domiciliary account which he had opened with the bank in 2020 however, this payment went to a new domiciliary account that the bank had opened for him without his knowledge or permission. Upon receiving an SMS alert from the bank informing him about his new account and the $450 credited into it, he visited UBA’s head office at Marina, Lagos, demanding an explanation. The bank’s risible explanation was that it had opened the new account for him so as to comply with the CBN’s ‘Naira 4 Dollar’ scheme which authorized banks to set up domiciliary accounts for customers that did not have them. Seeing as he already had a domiciliary account, this was clearly a nonsensical reason, but the bank refused to refund the money into his existing account or close the fraudulent account, even after he wrote to them with these demands twice. Nworah decided to go to court, and then – coincidentally – UBA immediately sent his lawyer a letter claiming that the new account had been opened due to a “system glitch” and that the $450 had been refunded to his existing account. No bank statement or proof was provided to corroborate the alleged refund. Delivering his ruling, Justice Aluko said:

For Nworah, the story at least had a happy ending. The customer in the next story had no such luck. Polaris Bank And The Customer Who Can’t Get An Account StatementIn 2008, Yorkshire Limited, a private company in Lagos took out a loan from Polaris Bank, which was then known as Skye Bank. The initial loan amount remains shrouded in secrecy as I was not able to get hold of the initial loan agreement. All that is known for sure is that it was a 10-figure amount, and all was going well until December 2013 when Skye Bank sent the company a confirmation of its loan balance stating that it was N4,159,319,763.53. A few hours later on the same day, another confirmation of loan balance came in from Skye Bank with a completely different figure on it. This time, the stated loan balance left to be repaid was N5,262,074,147.09. No explanation was offered for why there was a N1.1 billion disparity. Alarmed by the unprecedented phenomenon of a bank getting its customer’s account balance wrong by over N1.1 billion, the company requested a statement of account from Skye Bank, and this is where the “fun” started. Skye Bank did not provide the statement or give any reason why. Between 2013 and 2017, the company made several attempts to obtain a statement of account from Skye Bank – something that should normally be provided instantly after a single request. Still, no statement was forthcoming from the bank. In October 2017, the company wrote officially to Skye Bank asking for its statement of account. Once again, Skye Bank ignored the request and offered no explanation. Finally in December 2017, the company went through the legal route, writing the bank through its legal consultants, Wiseview Legal Consultancy to demand for its statement of accounts. Once again, there was radio silence from Skye Bank. Finally Yorkshire Limited went to court, obtaining a ruling from the Federal High Court in Lagos on April 17, 2018 ordering Skye Bank to provide the requested statement of account immediately. Still Skye Bank refused to produce the requested statement, despite this clearly being a violation of a court order. On April 19, 2 days after the court judgment, the company’s lawyers once again wrote to Skye Bank demanding that the bank comply with the court order and provide a statement of account for Yorkshire Limited. Yet again, Skye Bank responded with – nothing. No statement. No explanation. No conversation. Nothing. On April 26, 2018, company lawyers once again wrote to Skye Bank demanding for the account statement as ordered by the court. Once again, no prizes for guessing Skye Bank’s response. Yorkshire Limited also wrote to the CBN without getting any significant response. Out of options, the company decided to go to court a second time to get the prior ruling enforced. Instituted at the Federal High Court in Lagos on April 15, 2019, the suit sought to compel the bank (now Polaris Bank following a CBN takeover) to comply with the prior court order and produce the statement of accounts which it had been hiding since 2013. At this time, following Skye Bank’s transformation into Polaris Bank, the Asset Management Corporation Of Nigeria (AMCON) had taken over the bank’s liabilities and assets, including its loan portfolio. Somewhere on this loan portfolio was Yorkshire Limited’s mystery loan without an account statement. In January 2019, AMCON wrote to Yorkshire informing the company that it now owned the loan. No loan balance was stated in the letter. With Yorkshire’s case in the Federal High Court pending and heading toward another loss for Polaris Bank, a bit of “magic” suddenly took place. First in March 2020, AMCON and Polaris Bank instituted a joint motion to dispute the jurisdiction of the Court to hear the case. This infamous “technical justice” tactic is one that typically characterises Nigerian court cases and keeps cases going indefinitely. This objection was apparently based on an amendment to the AMCON Act. The ruling by Justice T.G. Ringim which can be found here, makes for interesting reading. In the ruling, Justice Ringim ultimately agreed with the objection challenging the court’s jurisdiction, but he also confirmed that neither Polaris Bank nor AMCON had in fact, been able to substantiate their claim of Yorkshire’s indebtedness by providing any documentation to confirm the debt and its amount. Justice Ringim did appear to contradict himself in the same ruling. According to him, AMCON’s purchase of Yorkshire’s mystery loan with Skye/Polaris Bank in 2018, as stated by AMCON was also enough fact to suggest that Yorkshire is indeed indebted to Polaris Bank – even though nobody knows how much, including apparently AMCON and Polaris Bank itself. |

Breaking News

Business & Economy

Investigation

National News

Fraud, Ponzi Schemes And Terror Financing: A Story About Banking In Nigeria

- by Admin

- August 8, 2022

- 2 Comments

- 1277 Views

-

- by: Fraud, Ponzi Schemes And Terror Financing: A Story About Banking In Nigeria —

- 4 years ago

[…] Read more… […]

-

- by: Fraud, Ponzi Schemes And Terror Financing: A Story About Banking In Nigeria — Fraudsters News

- 4 years ago

[…] Read more… […]

Leave feedback about this