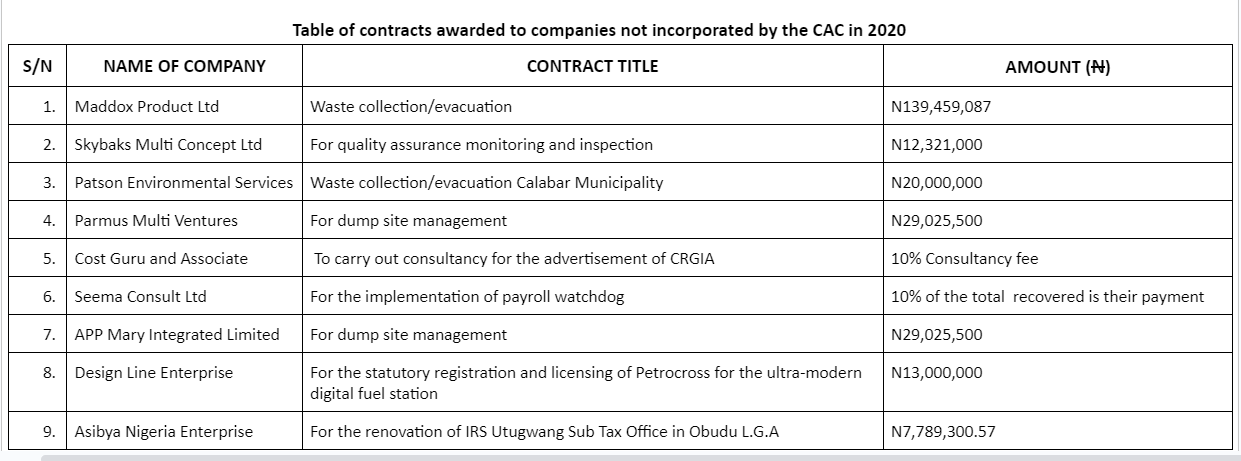

In 2019, the Cross River State Government awarded 40 contracts valued at over N6.9 billion to 31 companies. Of the 31, seven were illegally awarded contracts as they were not registered with the Corporate Affairs Commission, CAC, a fundamental requirement of the Public Procurement Act. Another 7 benefiting companies lacked experience and expertise concerning the contract they were awarded. In this investigation, Archibong Jeremiah established that the same scheme took place in 2020. This time over N600 million was paid to nine companies that are not registered or recognized under the law.

Michael Ini was buried in his gaze locked onto the drama of a waste evacuation team struggling with their rickety truck to enter the dump site near his shop located in Lemna, Calabar, the Cross River State capital.

He was so immersed in the drama that he forgot the customer he was attending to was dying of thirst. “Poor men,” he said soberly. Questioning the reason for the comment, he quickly referred the customer to the scene of the tired men battling with their truck.

Quickly, this reporter hurried to the scene where the driver and his conductor, with no hand glove and nothing to protect the nose, eye, and entire head but just a pair of old boots, battled the mountain of refuse in front of them.

The exhausted men when approached by this reporter referred to a senior staff member who spoke on anonymity for fear of victimization. “Our working conditions here are poor, once employed you are alone. You get your boots and gloves yourself,” he lamented.

He further disclosed: “We don’t have any health care system, we don’t have good machines,” adding that, “we get fuel for four hours to power our bulldozer and it’s expected to carry us for the eight hours we work.”

The contract to manage the dump site and eleven others valued at over N600 million, awarded by the state government formed the basis of this six-week investigation by CrossRiverWatch, revealing a large-scale breach of the public procurement processes.

Procurement Violation

Parmus Multi Ventures and APP Mary Integrated Limited, both companies not registered with the Corporate Affairs Commission, CAC, were paid N29,025,500 each to manage the Lemna dump site. Skybaks Multi Concept Ltd, another unregistered company, was paid N12,321,000 for quality assurance monitoring and inspection for the same dump site. The contracts violate the Cross River State Procurement Law, 2020 (Law No. 9).

Given the fact that the state procurement law was first enacted in 2007 and was reenacted in 2019, a year after the contracts were awarded, one would imagine that due diligence would have followed to set a precedent, but the reverse was the case. Twelve contracts out of the twenty-seven awarded between February, March, April, August, and October 2020 were awarded in manners that question the integrity of the state government.

Awarding nine contracts to companies not incorporated by the CAC breaches Part 3, Section 6(b) of the State Procurement Law which states that all bidders “shall possess the legal capacity to enter into the procurement contract.”

The unqualified companies uncovered during this investigation are Maddox Product, APP Mary Integrated Limited, Skybaks Multi Concept Ltd, Patson Environmental Services, and Parmus Multi Ventures.

Others are Cost Guru and Associate, Seema Consult Ltd, Design Line Enterprise, and Asibya Nigeria Enterprise.

Patson Environmental Services later registered with the CAC on June 28, 2021, nearly two years after getting the contract award from the Cross River State government.

Another critical finding by this reporter is that none of the twelve projects was budgeted for, an act which violates Section 1.4, sub-section 1 of the procurement guidelines and rules. The section mandates that all projects “must have budgetary provision.”

It was not immediately possible to ascertain whether the contract process benefitted from any exemption under part 3—Fundamental Principles for Procurements of Law No. 9. Part 3 (21b) states that “based only on procurement plans, supported by prior budgetary appropriations, no procurement contract shall be awarded until the procuring entity has ensured that funds are available to meet the maturing obligation and subject to the threshold in the Regulations made by the Bureau, has obtained a ‘Certificate of ‘No Objection’ to ‘Contract Award’ where applicable.”

Legitimate Companies Kicked Aside

Three companies bided for the contract to manage the Lemna dump site but curiously, the unregistered one, Parmus Multi Ventures, got the contract. The two other companies are Peter Okoni Junior Enterprises and Brentinor Ventures.

CrossRiverWatch established that Parmus Multi Ventures is not registered with CAC while the others are, but it got the N29,025,500 contract. According to records from the Department of Due Process And Price Intelligence Bureau, the unregistered company has 24 employees and assets valued at N151 million.

After six different visits to the company’s address, No. 1 Aquaedor Crescent Ekorinim, it was discovered that the address was non-existent. In Ekorinim 1 and 2, no one recognized the address or the company.

The contract award process was done through selective tendering, raising more concern as to why the contract was awarded to the exact amount Parmer Multi Venture proposed.

Contractors Yet To Handover Projects Three Years After

Asibya Nigeria Enterprise, another company not registered with CAC, was contracted to renovate the Internal Revenue Service, IRS, Utugwang sub-tax office in Obudu Local Government Area, LGA, and was paid N7,789,300.57.

On visiting the site, it was confirmed that the contractor only roofed and painted the building. The three-room apartment is empty, it has no furniture and appliances.

The contract was awarded on October 2, 2020, and was to last for six months. Residents around the facility said that the roofing and painting of the building were done in the first quarter of 2022.

The contract for the construction of the Tax Office at Effraya Etung LGA for IRS staff and fencing of Ogoja tax offices was awarded to Vicbreka Premium Synergy for N11,530,671.25.

The fencing of the Ogoja tax offices was done last year, however, the back was not finished – it was not plastered and painted.

While in Etung, residents confirmed that the contractor began work this year and work is still ongoing. A section of the roof is bad, the fence needs finishing touches, and leftover blocks are lined up close to the gate.

CrossRiverWatch investigation revealed that the Etung tax office in Effraya and the Utugwang sub-tax office in Obudu is not yet in use, work is still ongoing, and the contractors have not handed over the projects. The projects are implemented by the Internal Revenue Service.

Ghost Companies And Projects

In 2015, immediately after he was sworn in as the governor of Cross River State, Ben Ayade unveiled a plan to build and operate an ultra-modern filling station called Petrocross to boost the state’s revenue and transform the state that is hitherto known as a Civil Servants’ State into a private investment-driven one.

In October 2020, the sum of N13 million was released to Design Line Enterprise, another registered company, for the statutory registration and licensing of Petrocross for the ultra-modern fuel station. The company was first registered on 15 June 2005 during Governor Donald Duke’s term with registration number 626239 as Petrocross Refineries & Petrochemicals Co Ltd.

This investigation revealed that despite the release of funds for the contract which had a lifespan of six months, the ultra-modern filling station is yet to be completed.

It has neither physical presence nor has not commenced operations, although its name continues to ring a bell in the ears of members of the public. Cross River State has only one ultra-modern petrol station (Leophina Oil) owned by the Ayade family along Murtala Mohammed Highway, Calabar, which began operation in 2021.

Likewise, the contract to construct the palm oil refinery awarded to Biana’s Project Ltd for N380,031,069.60 has no physical presence.

The project, which was not budgeted for like the other ten, only exists on paper and in news reports and social media posts.

Parmus Multi Ventures was incorporated on 07 Jan 2014 and has offices, as contained in the government document, at No. 10 Esam Abasi Street. But the company does not exist at the given address. When this reporter visited the address, it was discovered that two compounds share the same address and no one recognized Biana’s Project Ltd.

Aside from Biana’s Project Ltd whose project is implemented by the Ministry of Industries, three other companies’ addresses were not found in the location contained in the government document.

They are Parmus Multi Ventures (No 1 Aquaedor crescent ekorinim), Vicbreka Premium Synergy (River Park estate MCC), and Asibya Nigeria Enterprise (20 MCC).

Citizens Should Be Empowered To Demand Accountability – NGO

Reacting to the findings of this investigation, the Country Director of Citizens Solution Network, Comrade Richard Inoyo, said the disclosures “calls for concern.”

He said, “When these issues are raised too often, anti-graft agencies rarely respond, there is a need to reach out to them to investigate the contract mafias.” Adding that “Those behind the unregistered companies should be exposed, tracked and interrogated.”

As a solution, he opined that “When the government gives a contract and after the time the contract is supposed to be in existence, and it fails to come to reality, the community must take it upon themselves to write the anti-graft agency or attorney general of the federal and the chief judge of the state.

“The people need to rise and demand accountability from the government, it is one thing for the media to bring out this information but it is another for the citizens to write and get EFCC to look into this.”

In Conclusion, Inoyo said, “There is a need for us in the civic space to come together to insist that when the contract is not executed the money paid should be collected and returned to government coffers.”

Authorities Explain

After several attempts to get the Cross River Internal Revenue Service Chairman, Dr. Ukam Edadi, to react to the findings of this investigation failed, the Head of Administration, Omini Esu, politely declined to grant an interview.

She explained that Ukam was in a Zoom meeting and had been very busy.

The Commissioner for Industries, Mr. Peter Egba told this reporter on the phone that despite contracting Biana’s project limited: “The palm oil refinery project was not executed again due to lack of funds.”

The Director General of Due Process and Price Intelligence Bureau, Mr. Francis Ekpo told this reporter on the phone that: “From our records, all the companies have CAC registration.”

After complaining that the FOI sent earlier was vague, he asked that another be sent with more information to aid his internal investigation. It was delivered to his office on Monday, 8 May 2023 afternoon. He promised to respond, but at press time, he is yet to reply.

This investigation is supported by the John D. and Catherine T. MacArthur Foundation and the International Centre for Investigative Reporting.

Leave feedback about this