By Omobola Tolu-Kusimo, The Nation Newspaper

Edo Leads

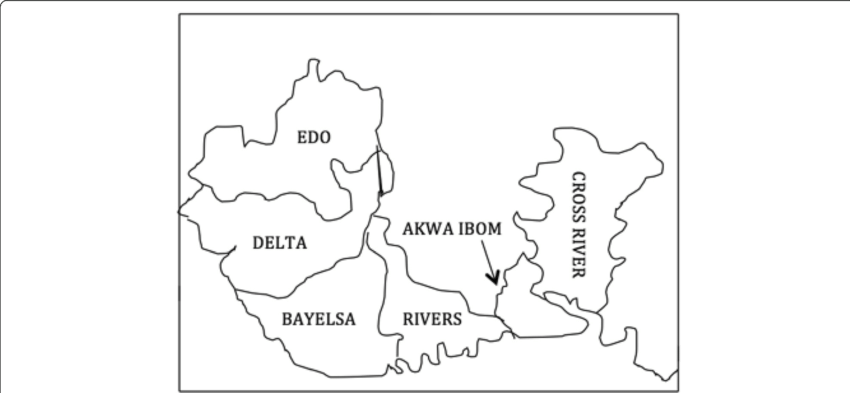

Civil servants in Akwa Ibom, Cross River, and Bayelsa States may not retire well due to the non-implementation and compliance of pension laws by their governors.

But civil servants of Edo, Delta, and Rivers States have a lot to benefit from upon retirement as their State Governors have complied with the pension laws, with Edo standing out as the best.

The Nation found this in a document by the National Pension Commission (PenCom) titled, “Status of Implementation of the Contributory (Pension Scheme (CPS) in States of South-South Zone as of June 30, 2022.

Akwa Ibom

Although Akwa Ibom State Government drafted a Bill on CPS in 2017, it is yet to

enact a law on the CPS to guide the implementation of the scheme. Besides, it is yet to establish a Pension Bureau; or register the employees with PFAs; and it has not begun the remittance of pension contributions for the employees.

The State is also yet to conduct an actuarial valuation to determine the employees’ Accrued Pension Rights. It is yet to open a Retirement Benefits Bond Redemption Fund Account. It is yet to commence funding of the Accrued Pension Rights and institute a Group Life Insurance Policy for the employees.

Cross River

In the same vein, Cross Rivers State Government drafted a Bill on the CPS in 2021 but is yet to enact a Law on the CPS to guide the implementation of the scheme.

The State Government is yet to establish a Pension Bureau or register the employees with PFAs. It is yet to commence remittance of Pension Contributions for the employees. It has not conducted an Actuarial Valuation to determine the employees’ Accrued Pension Rights or open a Retirement Benefits Bond Redemption Fund Account. The State is yet to commence funding the Accrued Pension Rights or institute a Group Life Insurance Policy.

Bayelsa

While the Bayelsa State Government enacted a Law on the CPS in 2009 and established two Pension Bureaus for State and Local Governments, it is yet to register the employees with Pension Fund Administrators (PFAs) It is yet to commence remittance of Pension Contributions or conduct an Actuarial Valuation to determine the employees’ Accrued Pension Rights. The State is yet to open a Retirement Benefits Bond Redemption Fund Account or commence funding of the Accrued Pension Rights and has yet to institute a Group Life Insurance Policy.

The best pension State, however, is Edo State. The State Government enacted a Law on the CPS in 2010 with an amended Law in 2017.

The State has also established a Pension Bureau; registered the State Employees with PFAs; Remitting 10 percent of employer and 8 eight employee pension contributions; conducted an actuarial valuation to determine the employee’s accrued pension rights; has a valid Group Life Insurance Policy; opened a Retirement Benefits Bond Redemptions Fund Account with a PFA; commenced funding of accrued pension rights.

Delta

While Delta State has huge arrears of Accrued Pension Rights and is yet to institute a Group Life Insurance Policy, it has enacted a Law on the CPS in 2008 (amended the Law 2011), the State established two Pension Bureaus for State and Local Governments; registered the employees with PFAs; remitting 10 percent employer and 7.5 percent employee pension contributions with remitted pension contributions up to January 2022 for employees of the state and up to July 2021 for employees of the local governments.

The State has also conducted actuarial valuations to determine the employee’s accrued pension rights; opened Retirement Benefits Bond Redemption Fund Accounts with the CBN; and funded the accrued pension rights regularly.

Rivers

In the case of Rivers State, the government is yet to conduct an Actuarial Valuation to determine the employees’ Accrued Pension Rights; yet to commence funding of the Retirement Benefits Bond Redemption Fund Account; yet to institute a Group Life Insurance Policy.

But the State enacted a Law on the CPS in 2009 which was repealed and re-enacted the Pension Law in 2019 with the transition period extended to 2022. It established a Pension Bureau, registered the Employees with PFAs, and remitted 7.5 percent of employer and 7.5 percent of employee pension contributions under the repealed law.

The government, however, stopped remitting the employer contributions in 2016 but the contributions under the repealed law are now being refunded.

Although the remittance of employee contributions has commenced under the new law, the remittance of employer contributions is yet to commence.

Besides this, the government opened a Retirement Benefits Bond Redemption Fund Account with a PFA.

It is, however, yet to conduct an actuarial valuation to determine the employees’ Accrued Pension Rights.

The government has not commenced funding of the Retirement Benefits Bond Redemption Fund Account or instituted a Group Life Insurance Policy.

Leave feedback about this