By Ushang Ewa

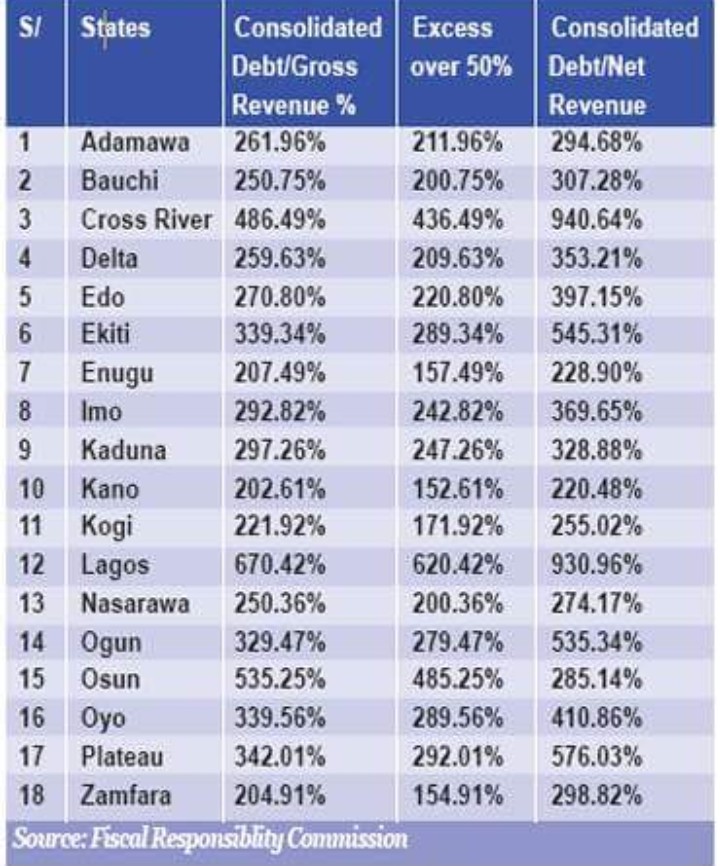

The total debts of Cross River State as at December 2016 exceeded its statutory revenue by 486.49% says the Fiscal Responsibility Commission (FRC) 2016 Annual Report.

This is contrary to the guidelines of the Debt Management Office (DMO) on debt sustainability which states that the debt status of each state should not exceed 50 per cent of the statutory revenue in the previous 12 months reports the PUNCH newspapers which obtained the report.

The report stated: “In the light of the DMO’s guidelines on the Debt Management Framework, specifically, sections 222 to 273 of the Investment and Securities Act, 2007 pertaining to debt sustainability, according to the guidelines, the debt to income ratio of states should not exceed 50 per cent of the statutory revenue for the preceding 12 months.”

But, Cross River State came third behind Lagos and Osun states with the debt to gross revenue.

In fact, the debt to net revenue ratio of the state even put it in an even more precarious situation as Cross River topped the list at 940.64 percent and was closely followed by Lagos state at 930.96 percent.

The debt to revenue ratio is very important in debt analysis as it can give an indication of the capacity of the debtor to service and repay the debt the PUNCH reported.

And, with Cross River recording dwindling revenues according to the National Bureau of Statistics (NBS) which said as at the end of the first half of 2017, the state’s revenue had declined by 2.28 percent year-on-year.

And, following the exemption of several categories of people and businesses from tax, economic watchers say the worst indices are yet to come as interest piles up.

This is even as the state failed to record any foreign direct investment last year according to the NBS.

An aide to Governor Ben Ayade however, denied this, pointing out the Governor’s foreign investment drive was yielding results.

However, as at December 2017, the external debt had risen to over USD168 million (approximately NGN60.5 billion).

But, the FRC said the fact that some states exceeded the threshold of 50 percent does not mean they over borrowed.

“It should be noted that the fact that some states exceeded the threshold of 50 per cent of their total revenue is not an indication that they over-borrowed as the debt limits of the governments in the federation are yet to be set.

“Furthermore, only total revenue is used for the foregoing analysis as comprehensive data on the states’ Internally Generated Revenue were not available. In any case, the IGR on the average is not more than eight per cent of the states’ total revenue except for Lagos State. In essence, the non-inclusion of the IGR may not distort the result of the analysis.

“Therefore, there is a need for each of these states to work towards bringing their respective consolidated debts within the 50 per cent threshold of their total revenue in order to guarantee a general public debt sustainability in the country,” the report stated.

However, the state has in different fora cried that it can’t borrow with the Governor claiming that the deductions at the DMO after receiving the monthly allocation leaves the state with basically nothing to spend.

Since You Are Here, Support Good JournalismCrossRiverWatch was founded on the ideals of deploying tech tools to report in an ethical manner, news, views and analysis with a narrative that ensures transparency in governance, a good society and an accountable democracy. Everyone appreciates good journalism but it costs a lot of money. Nonetheless, it cannot be sacrificed on the altar of news commercialization. Consider making a modest contribution to support CrossRiverWatch's journalism of credibility and integrity in order to ensure that all have continuous free access to our noble endeavor. CLICK HERE |

New Feature: Don't miss any of our news again.Get all our articles in your facebook chat box.Click the Facebook Messenger Icon below to subscribe now

Text Advert by CRWatch :Place Yours

Will You To Learn How To Make Millions Of Naira Making Special Creams From Your Kitchen?.Click Here

Expose Your Business And Make More Sales. Advertise On CrossRiverWatch.com Today

Leave feedback about this