By Archibong Jeremiah, Sylvia Akpan and Theresa Mba

Cross River State Government has not been able to successfully implement its Law No. 13, 2015 – Tax Exemption (of Low Income Earners) Law, which was conceived to give ministration to “the poor,” according to Governor Ben Ayade.

With his (Ayade) dramatic cries (on camera) for “the poor,” and open confession to his poor upbringing, one would ordinarily expect that the law would be dear to the Government, in content and execution but the reverse is the case, CrossRiverWatch investigation has revealed.

The objective of this law with controversial beneficiaries is to create a tax exemption regime, that is subject to the provision in section 3 (2) of the law, that requires the Governor to periodically publish the list of beneficiaries, and set it before the House of Assembly.

Investigation by this newspaper reveals further that, from 2015 till date, no list of beneficiaries have been published, none has equally been laid before the House of Assembly but, controversial beneficiaries are exempted from paying tax.

An earlier investigation by CrossRiverWatch had revealed that, deception, tales of lies mar the implementation of the law.

Who Benefits From The Law?

In August 2015, Governor Ben Ayade hinted about a plan to rebate tax for “the poor,” January 2017 he abolished tax for the low income earners while in March 2018, the Cross River Internal Revenue Service (CRIRS) issued a public service announcement over Law No. 13 and in May 2020, the Anti-Tax Agency headed by Bishop Emmah Isong was inaugurated.

Governor Ayade during the media parley, August 19, 2015 where he revealed that the bill was before the Assembly listed beneficiaries as civil servants on minimum wage, petty traders, commercial motorcycle riders, popularly known as okada, recharge card vendors among others.

January 18, 2017, the Governor through his Chief Press Secretary and Senior Special Assistant Media, Mr. Christian Ita reiterated that, those exempted are “people earning below N50,000 monthly: taxi, tricycle, wheelbarrow, and motorcycle operators as well as petty traders and hoteliers.”

In the public service announcement by CRIRS on March 3, 2018, only four categories of beneficiaries were listed and they are restaurants and eateries, barbering and hairdressing salons, motorcycles and Keke Napep operators and petty traders.

May 21, 2020 when tasking the newly inaugurated Anti-Tax Agency, the Governor again confirmed who the beneficiaries are. In his words: “All those categories of people and those from time-to-time may be so announced by the Governor, including every single hotel that have less than 50 rooms today are exempted from the payment of tax. We have exempted all okada drivers, taxi drivers, airport taxi drivers.

“We have exempted small saloon owners, small catering and restaurant points, eatery points. All those small basic survival people selling produce, struggling to make a living have been exempted from paying tax. We have exempted them because it is better for me as a Governor that I rather tax my brain than to tax my people.”

Fact checking the category of beneficiaries put forward by the Government, the Cross River State Tax Exemption (of Low Income Earners) Law, Section 3 (1) and (2) reveals otherwise.

Section 3 (1) states that, the persons (beneficiaries) referred to in section 1 are as follows: “Low income earners employed by the State Government, physically challenged persons, persons with terminal diseases and persons employed by the State Government on humanitarian basis.”

Section 3 (2) states that: “For the avoidance of doubt, junior and senior staff who are employees of the State Government who fall under the categories of person in sub-section (1) (b)-(d) of this section are beneficiaries of this law: provided that upon the commencement of every financial year, the Governor shall by gazette publish a list of beneficiaries under this law and such a list shall be laid before the House of Assembly.”

After reviewing the law, open governance and accountability lawyer, Barrister Kehole Enya of Basic Rights Counsel accused the Government of “insincerity,” describing their action as “senseless”.

“As much as I can see in the provisions of the law, it is clear the people that are exempted,” he said adding that, “I do not think taxi drivers are exempted except the taxi driver can show he has terminal disease, and that he is physically challenged. You and I know that someone who is physically challenged, or has terminal disease might not be driving a taxi. The people who perhaps will benefit are those in the public service, who are working for the Government.”

No Evidence Government Paid Tax Of Those Exempted As Directed By The Law

Section 1 states: “(1) Upon the commencement of this law, the tax burden of the persons under section 3 (1) of this Law shall be borne by the State Government.

“(2) The Internal Revenue Service (IRS) shall therefore, upon the commencement of this law, compute monthly personal income taxes of all the affected categories of persons who are under the employ of the State Government and communicate the same to the Governor.

“(3) The Governor shall upon the receipt of the personal income tax figures from IRS, cause the same to be paid from the State Government’s account to the IRS account on behalf of the low income earners and others mentioned in Section 3 (1) below.”

Scrutinizing the annual report and accounts report of the State Auditor-General on the accounts of the Government of Cross River, from 2018 – 2020 there is no evidence that section 1, sub-section 1-3 has been satisfied in the drive to exempt low income earners from taxation.

Similarly, in the report of the Auditor-General for Local Governments on the consolidated accounts of the 18 Local Government Councils, from 2018 – 2020, CrossRiverWatch found no evidence that low income earners tax were paid.

Evidence That Those Exempted By Law And The Governor’s Authority Are Taxed

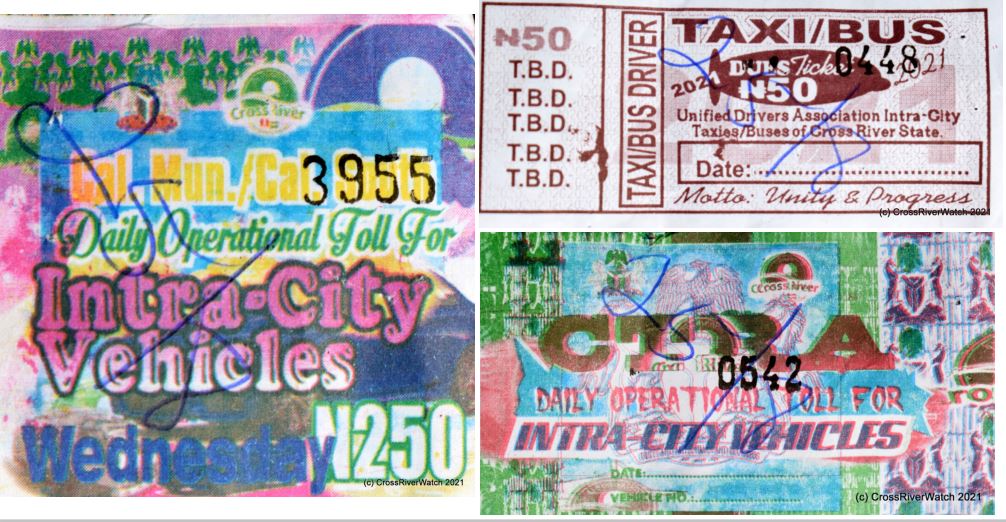

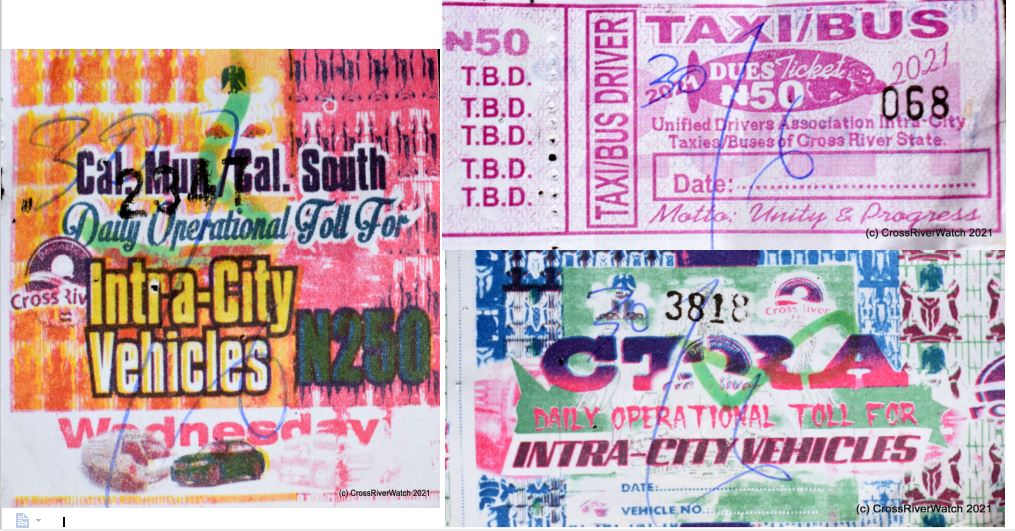

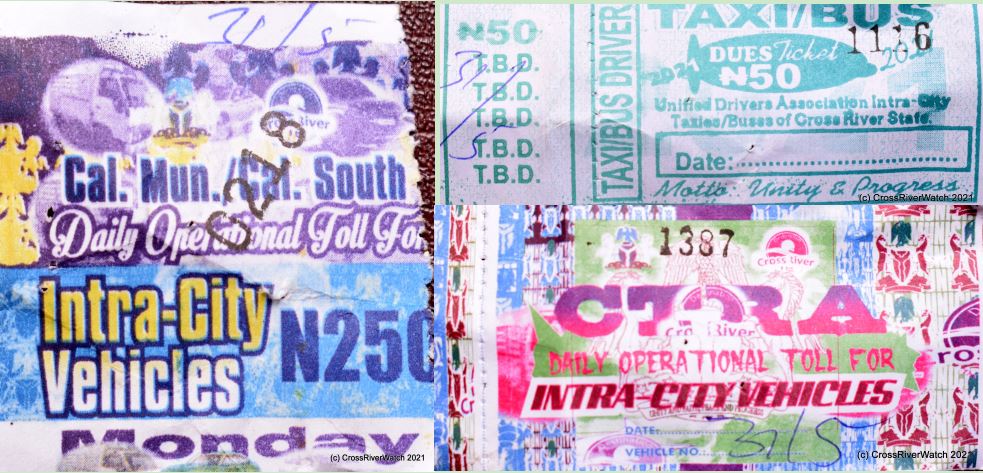

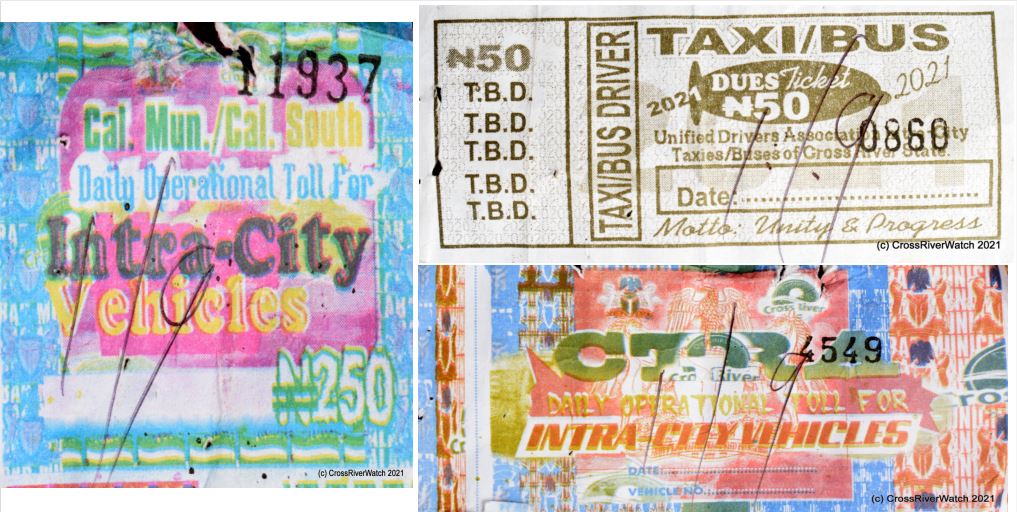

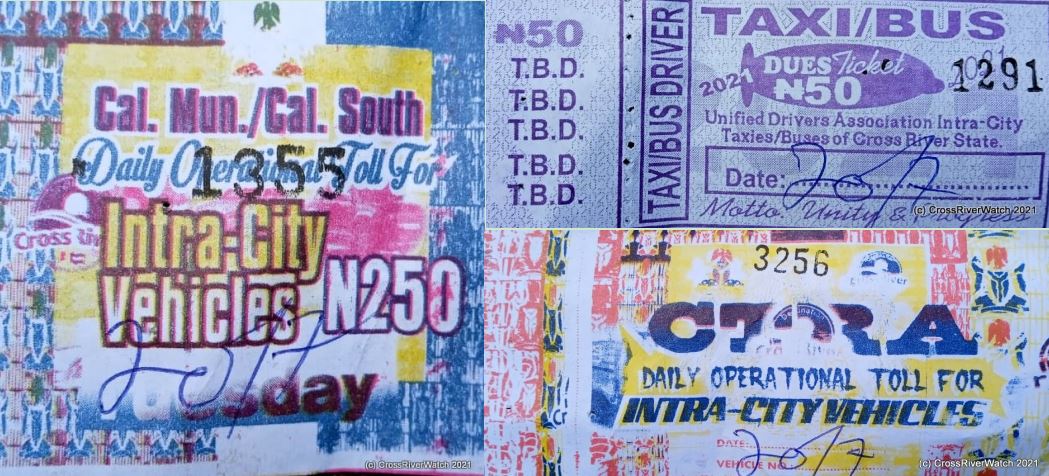

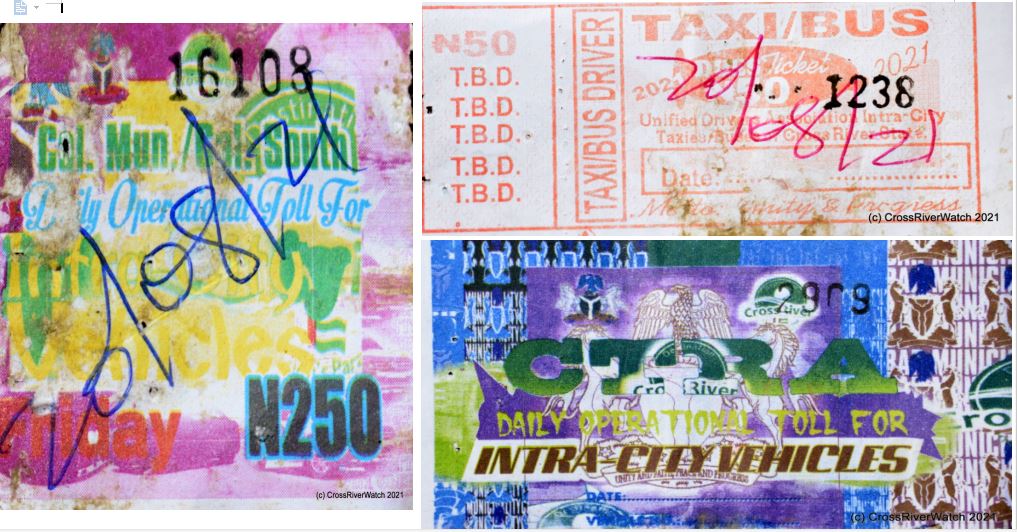

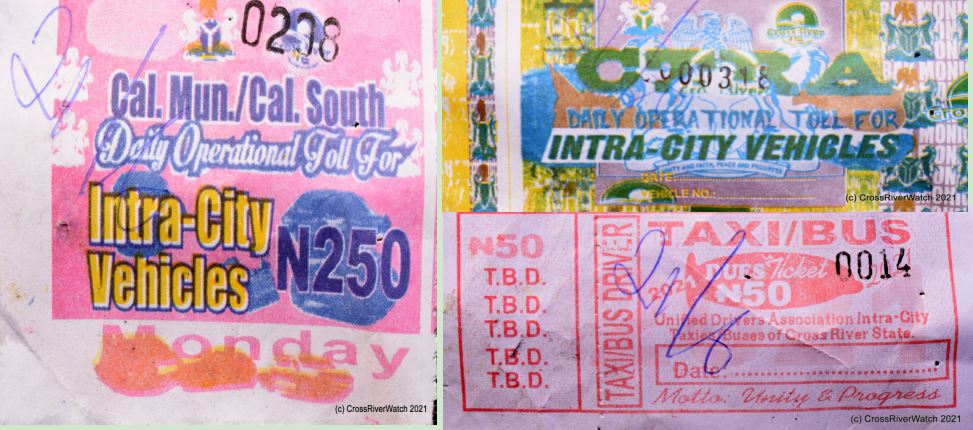

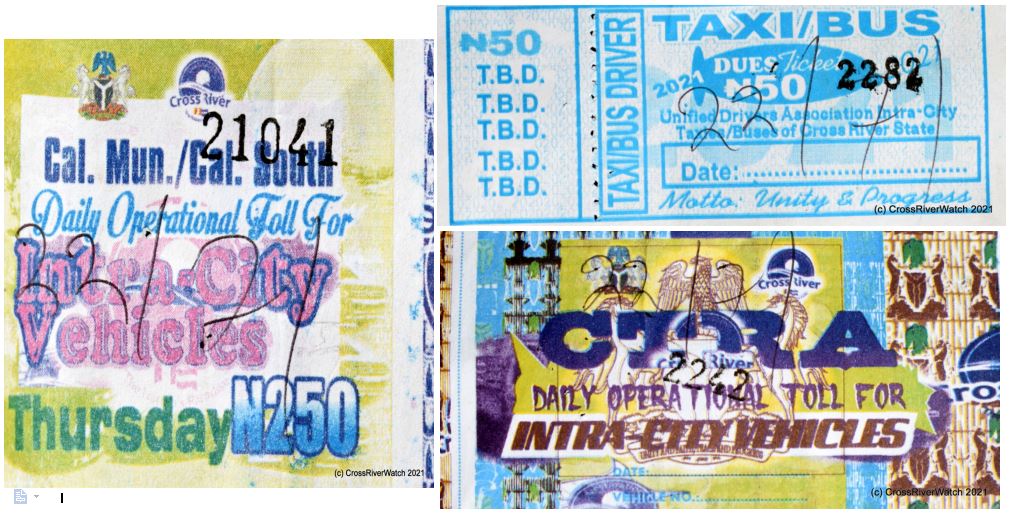

CrossRiverWatch documented evidence that those exempted from taxation by Law No. 13 and the Governor’s pronouncement are being taxed.

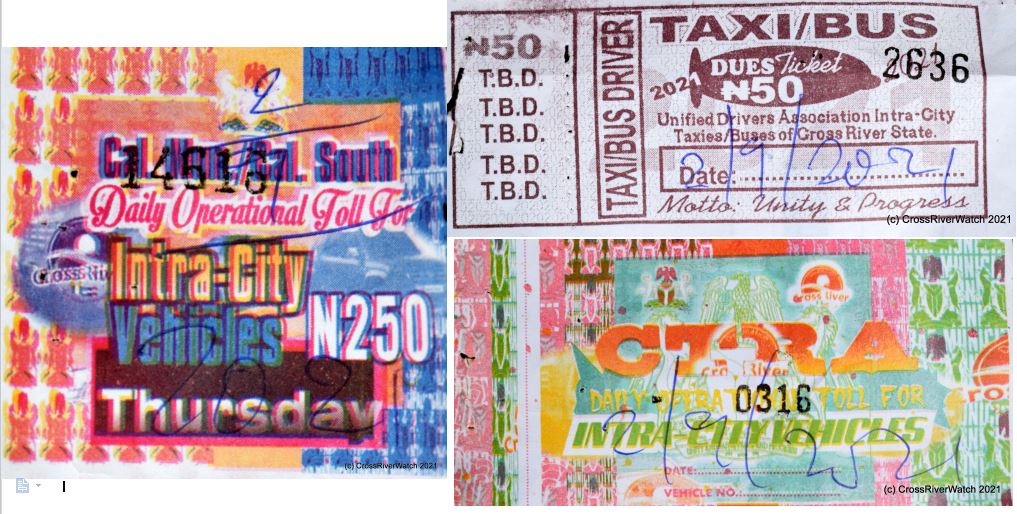

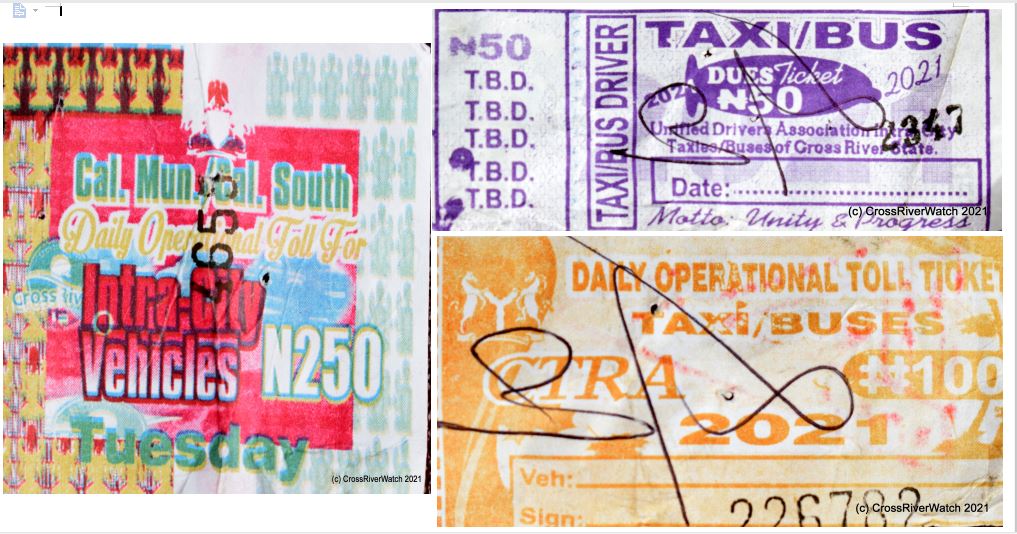

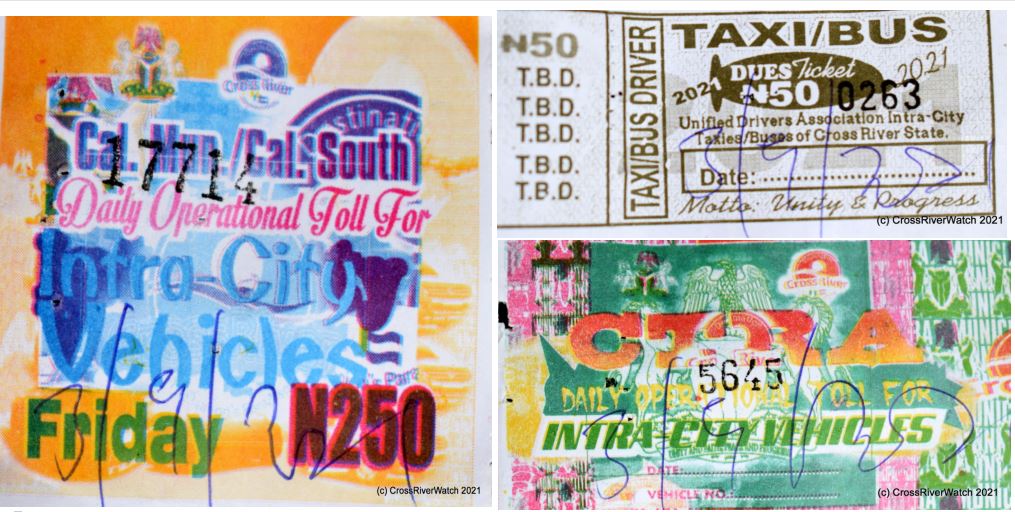

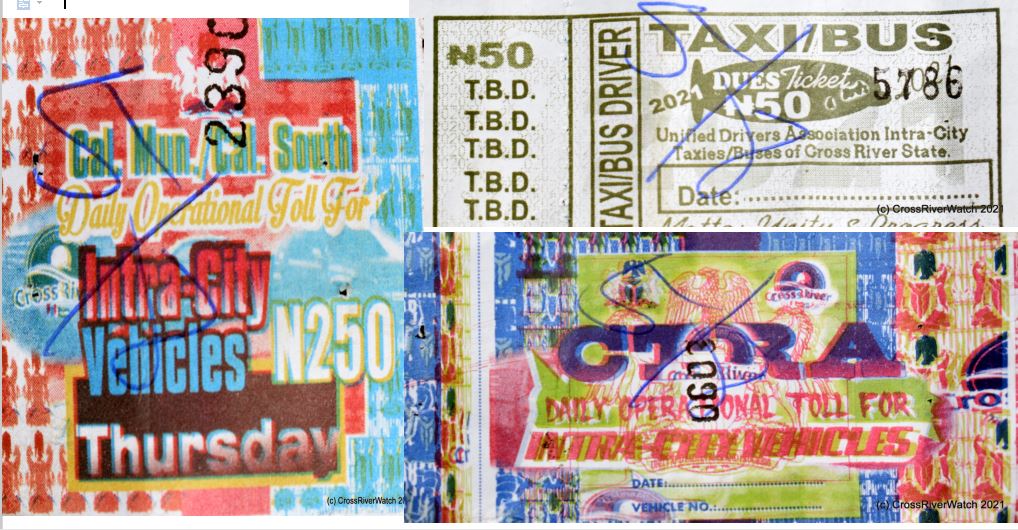

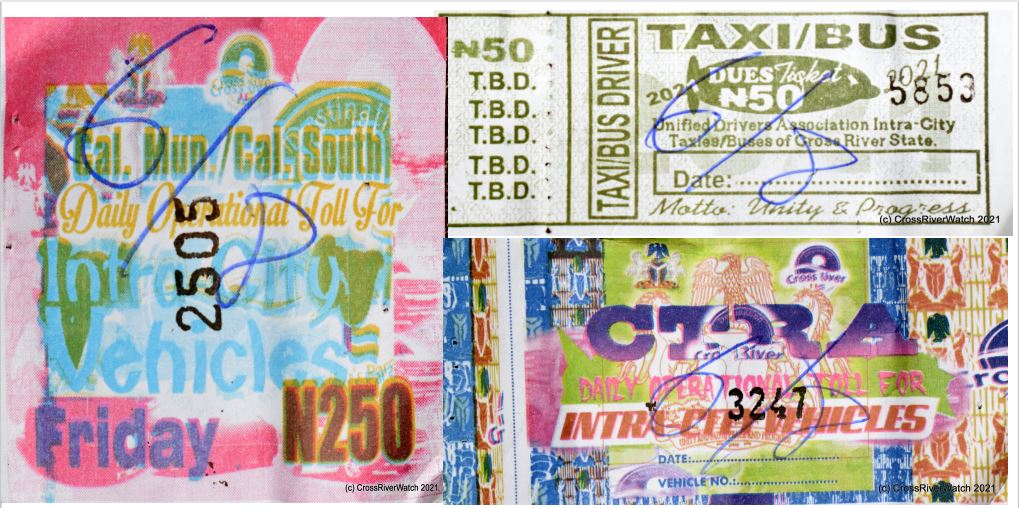

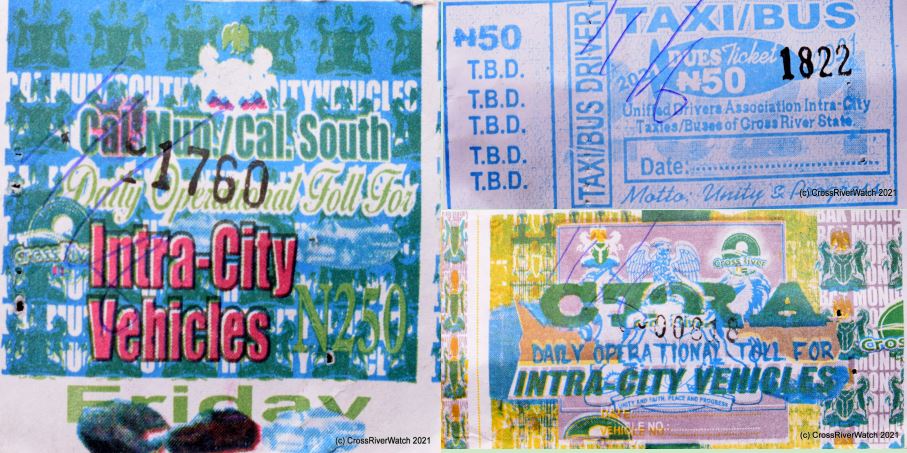

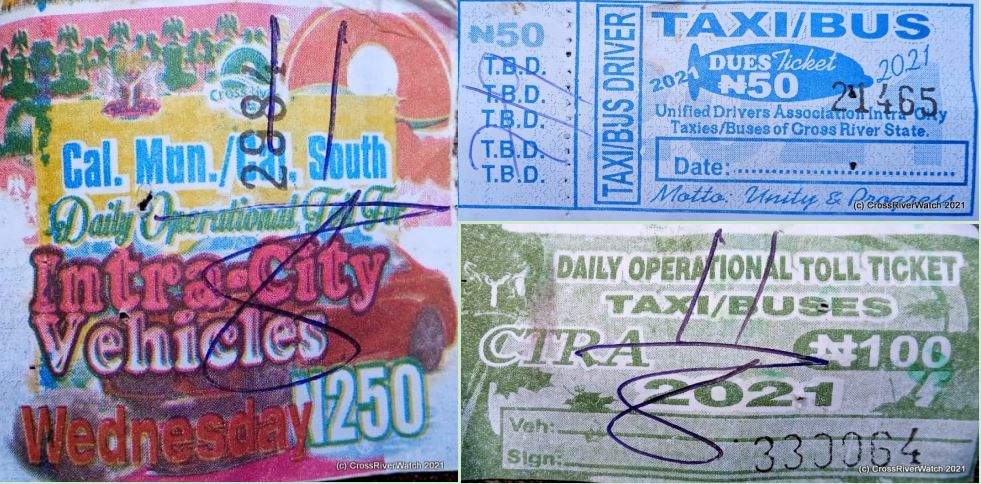

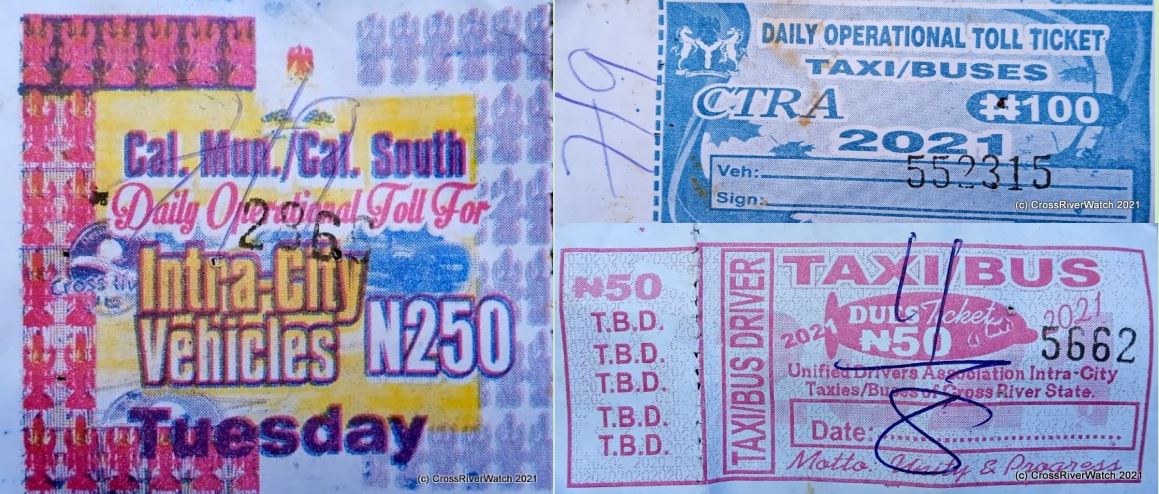

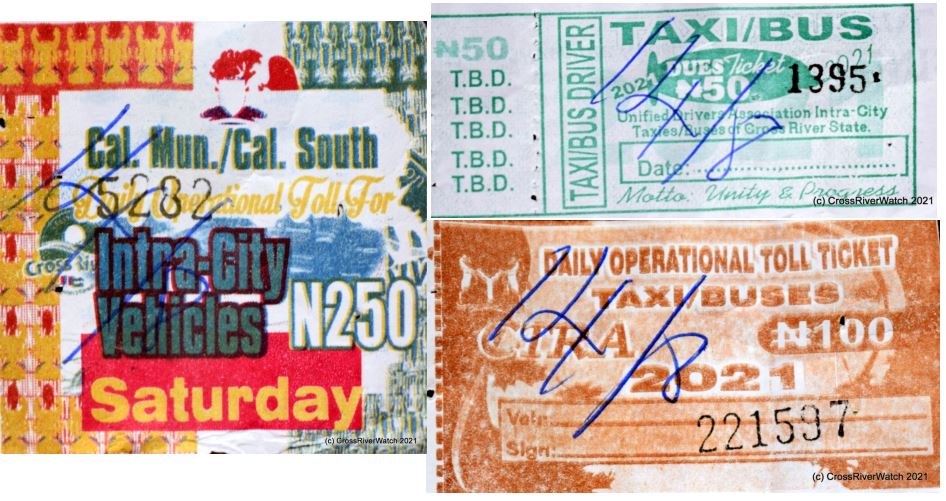

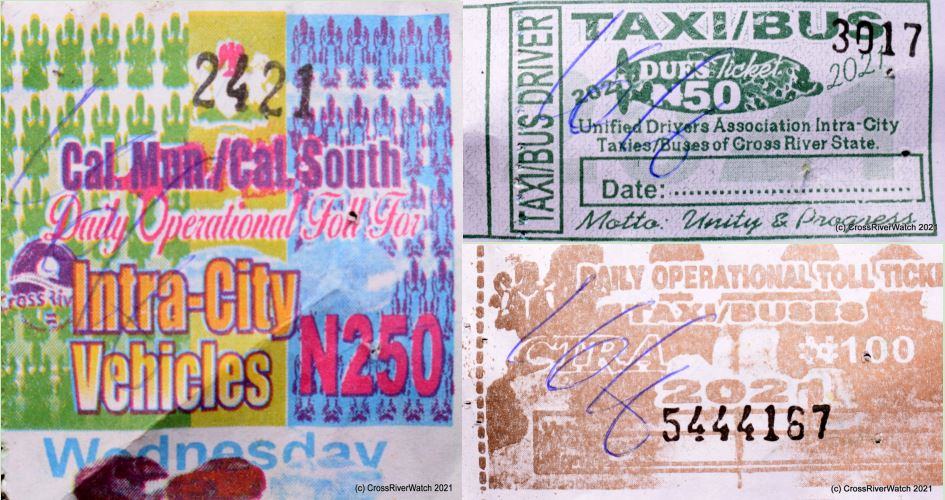

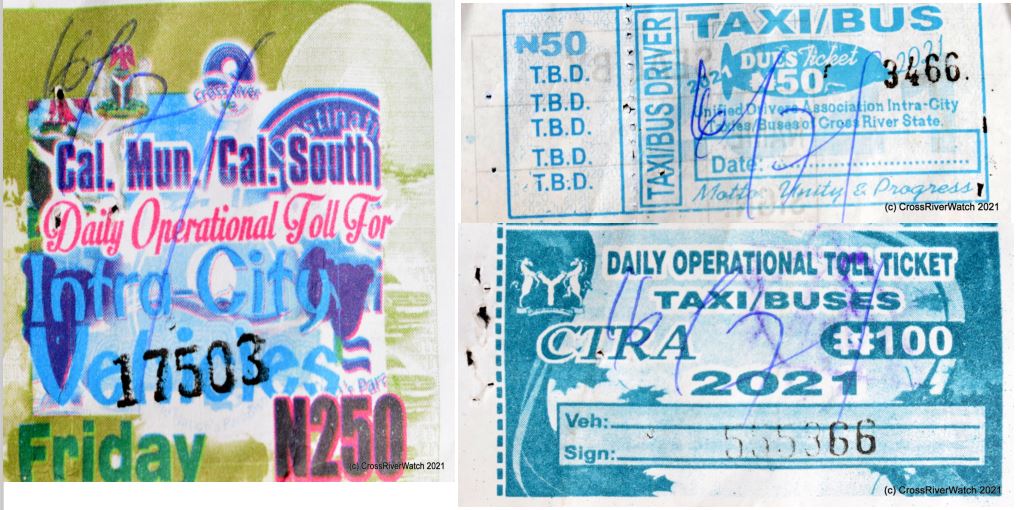

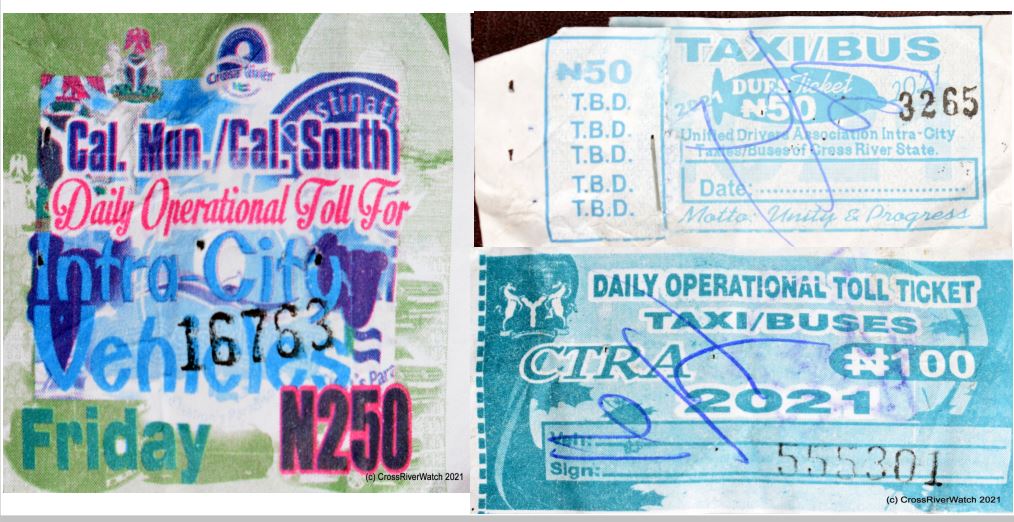

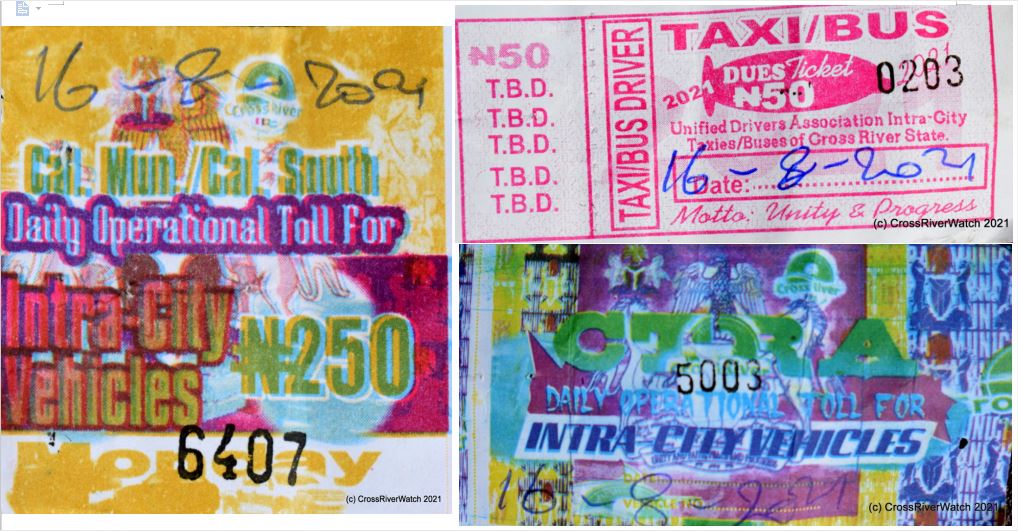

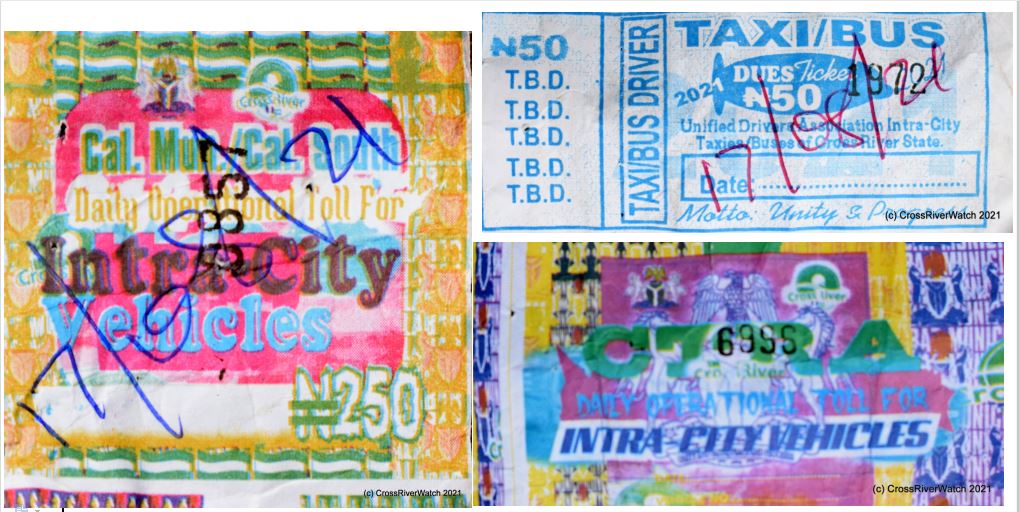

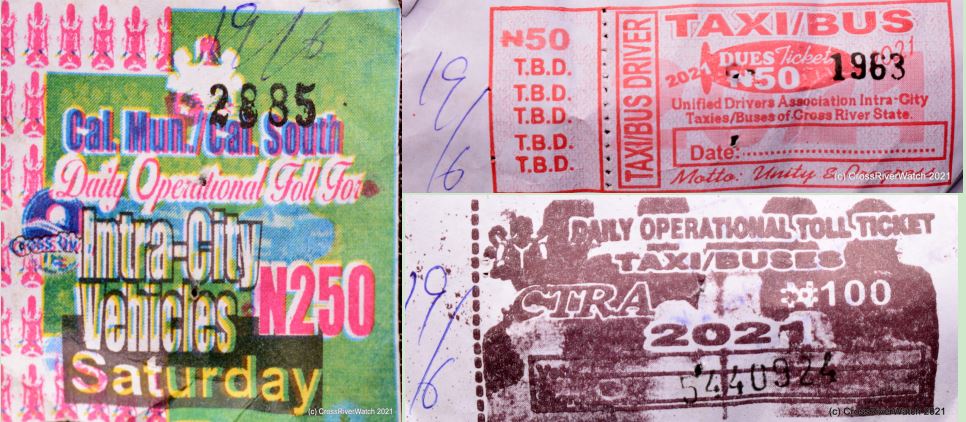

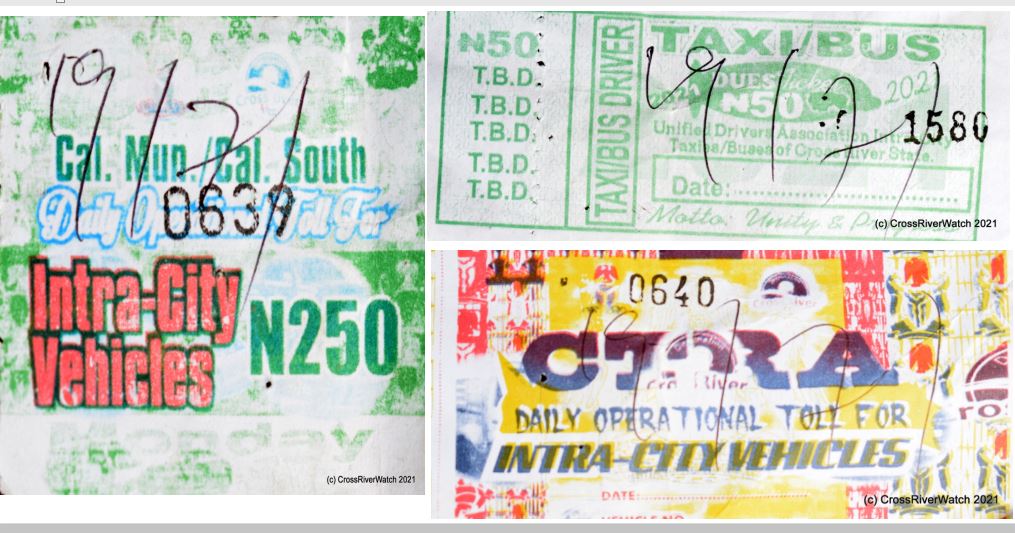

Drivers in the State capital still buy a daily ticket of N400 – N250 is shared between Calabar South and Municipality Local Government Council, N100 goes to Calabar Transport Regulatory Agency (CTRA) or 100 Marian (as popularly known) while N50 is for the drivers union.

See the daily tickets obtained by this investigation team within the 4 months of this investigation below.

See some daily ticket vendors on duty below.

See some daily ticket vendors on duty below.

See pictures of some enforcers used to tax petty traders in the main markets of Calabar (Marian and Watt) below.

Government Insincerity

The Cross River State Government has been ridiculed, criticized and praised for exempting “the poor” from taxation. In our earlier investigation we discovered that deception, tales of lies marred its implementation.

After sounding several warnings since the law was signed by the Governor, 18 arrests were made amidst a swamp of complaints yet no one has been prosecuted.

During the signing ceremony in the exco chamber, in 2017 Ayade warned, “I am therefore sounding the last warning that henceforth; I don’t want to hear any one who earns less than N50,000 a month being taxed in any form in the State.” He added that, “I have warned anybody who is still collecting money from these people to desist forthwith,” adding that “I have seen poverty in my personal life and I know what that small N2,000 means to them.”

In March 2018, in the public service announcement by CRIRS another warning was issued. It said, “all contractors as well as staff of the Internal Revenue Service are enjoined by this development to ensure strict compliance with His Excellence, the Governor’s directive.”

Two years after, May 2020 Bishop Emmah Isong, Chairman of the Anti-Tax Agency in a press release warned that, “henceforth, anybody caught in this illegal business shall be handed over to law enforcement officers for immediate prosecution.”

In May 2020, the Commercial Transport Regulatory Agency (CTRA) also known as 100 Marian was banned by the Governor for violating the tax exemption law but in less than two months they were back on the road.

June 2020, market women were beaten up by thugs for refusing to pay tax they have been exempted from, no was held accountable.

Four special mobile courts was set up in August 2020 to prosecute offenders, in September 2020, twelve offenders were arrested while in February 2021 six others were apprehended.

After making 18 arrests there is no record of successful prosecution of any offender since the creation of Law No. 3, 2015.

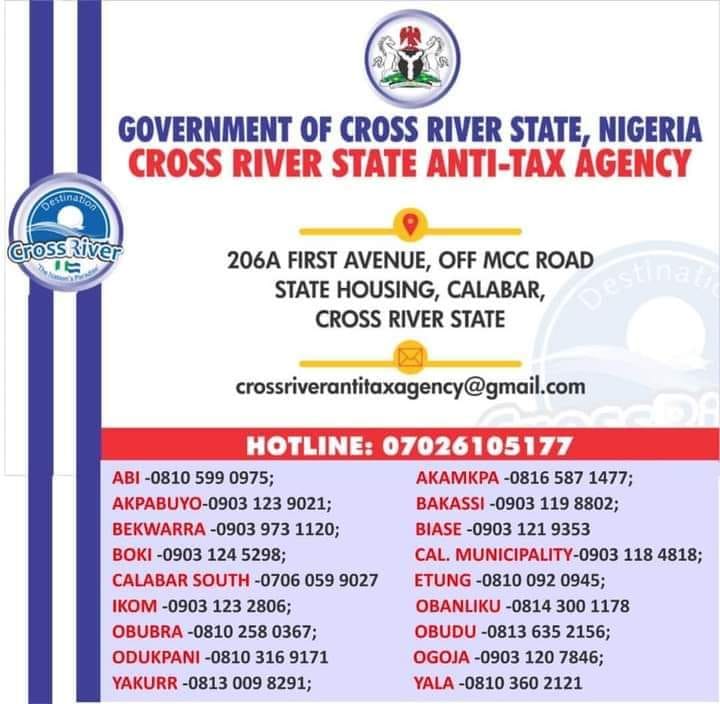

Months after exposing the fact that deception, tales of lies marred the implementation of the tax exemption (of the low income earners) law, the Anti-Tax Agency released catalogue of hotline and held a press conference accusing politicians of masterminding the violation of the law and threatened to report them to EFCC.

After 4 months of this investigation, the Calabar South and Calabar Municipality Chairmen never responded to enquires while Elder Gabriel Abegim Adah, Calabar Transport Regulatory Agency (CTRA) Chairman denied knowledge of any violation.

To prove his point of not being part of the extortion cartel he said, “I’m the first cousin to the Governor, there’s no way I will do what the Governor did not say. Anybody who is taxed will come to me. It’s the union and Local Government that is collecting tax.”

He added that: “We have Calabar South and Municipality and the union themselves, but we CTRA don’t collect tax from anybody. Go there and ask, is there any enforcement in the office that is arresting people for not paying tax, if we are collecting tax we must arrest people for defaulting. Our function is to register any vehicle used for commercial transportation.”

Rhetorically he asked CrossRiverWatch “should I arrest the Local Government Chairman?” adding that, “when you talk to them they will tell you their own story. When I confronted them they said in Atam (a non-official term used to describe people from Northern Cross River) we have land for planting but here, it is the taxi they have.”

Experts Call For Review Of The Law, Make Strong Prediction

During the Anti-Tax Agency stakeholders workshop held at UG-Wills hotel and suite Calabar, on August 26, 2020, Barrister Williams Anwan in his paper penned areas of the law that need clarity.

They are, “interpretation/definition: tax/livery rates/fact/charges earners and low income earners. Classification/categorization: name of agency/relevant agencies. Section 5 (relevant/agencies): privates, classification of beneficiaries. Establishment of Agency: power/functions/duties/offices/tenure/objective/funding. And power to include protection of beneficiaries from abuse of tax enforcement processes.”

Others are “composition of Advisory Council: Section 4 – inclusion of Chairman Anti-Tax Agency. Board of Director (stakeholders). Conflicts: harmonization of Local Government rates, levies, peers with taxes exemption. And offenses, punishments, enforcement procedures and jurisdiction – revenue Court/Special Court.”

Similarly, after accusing the Ayade’s Government of “insincerity,” and describing its action as “senseless,” Barrister Kehole Enya also said the law should be reviewed because it lacks key features.

When asked if the Government would be wrong in taxing those not captured in section 3 (1) he said, “I do not think there is any breach to the law if people are being taxed, because the law did not say they cannot tax any kind of low income earners, that is the crux of the matter in the law.”

He added that: “The law should be reviewed if the Governor is truly, truly sincere about it, it doesn’t make sense, it’s mere executive rhetoric meant to paint them in good light before the people.”

On his part, Mr. Kay Amaku, Manager of Dan Oku and Co Chartered Accountants and Consults predicted that “a time will come when there will be riot in the markets because the Government did not do its homework properly. You’re giving an Agency a responsibility it is not ready for.”

On implication he said: “The long-term challenge to the State is that people will not trust the word of Government, I cannot imagine that a Governor of a State will give a directive and people are flaunting the directive in broad daylight, in the face of security agencies.”

Mr. Amaku added that, “businesses will dwindle, already Cross River has issues of multiple taxes. The economy of the State is already dwindling, the State economy is not doing well. Their (petty traders) products are seized when they don’t pay and law enforcement agencies vehicles are the ones used to convey them.”

He maintained that, “the State is going to suffer because it rides on taxes, those taxed will not trust the Government. It’s one thing to enact a law, the most important is for it to be applicable.”

This Story was Produced in Partnership with Civic Media Lab Under its Grassroots News Project with Support from the National Endowment for Democracy.

Leave feedback about this